Newport Beach Estate Planning & Trust, Miramontes Capital

With the experience of our Newport Beach Trust & Estate Planning attorneys, clients of Miramontes Capital can help ensure financial stability for their loved ones long after they’re gone. We work closely with each client, determining your specific needs and goals, then developing a plan to protect your assets for the future.

What is Estate Planning?

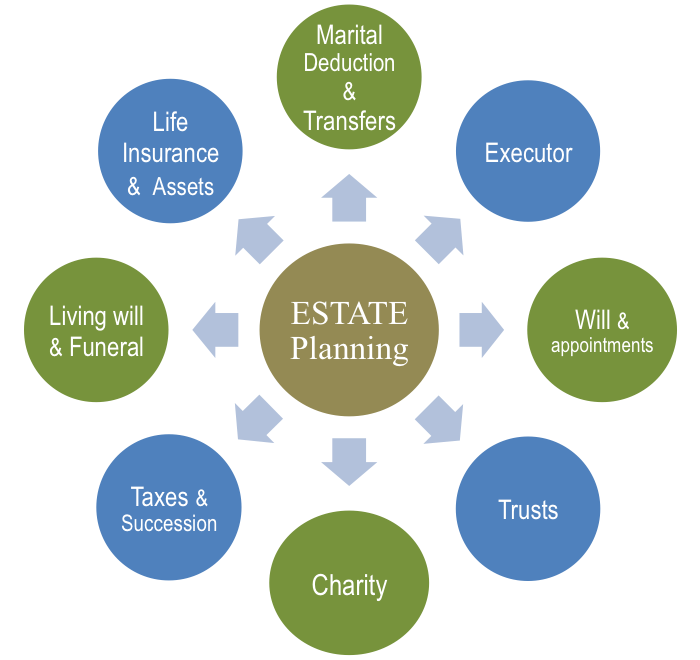

Estate planning is the process of arranging for the management of financial assets in life and at or after death. This planning process is designed to reduce impacts on the value of assets by minimizing estate, gift, and income taxes. There are many parts to Newport Beach Estate Planning, such as identifying current assets, anticipating future assets and their values, designating beneficiaries, and making arrangements for the disposal or distribution of those assets after death. Estate planning is complex and requires the assistance of an experienced estate planning professional.

What is a Trust?

A trust is another legal arrangement for directing the distribution of assets after the trust’s creator passes away. Trusts offer a high degree of control over the management of assets, both in life and after death. In simple terms, a person’s financial assets are entrusted to a third party known as the “trustee”, which can be a financial institution, a person, or a combination of both. This arrangement adds protection from estate and income taxes. There are many types of trusts, including revocable and irrevocable, living, and testamentary types.ers.

Newport Beach Estate Planning With The Miramontes Capital Team

Our experienced retirement planning professionals at Miramontes Capital are ready to help with comprehensive trust and estate planning services. With our help, you can take charge of your assets, setting a course for a stable financial future for you and your loved ones.

Area’s Of Most Estate Planning Concern

- Concerened About Legacy 93%

- Preservation Of Assets 67%

- What legacy will you leave? Planning for retirement is no simple task. There are many components that go into a solid plan for the time after we retire. Most of us know that saving money for the future is the goal of the planning process, but we tend to overlook one critical part: estate planning.

- Is a Will or Trust Best For Me? Typically, wills and trusts are estate planning tools, with advantages to each. A will is a relatively simple legal document that spells out a person’s wishes, such as which surviving family members will receive assets upon the will creator’s death. Wills name an executor, or someone who will administer the distribution of financial assets to surviving family members.

Newport Beach Estate Planning & Trust Checklist

-

Cover Estate Planning Basics

-

Plan Your Asset Ownership

-

Determine Beneficiary Designations

-

Cover Your Debts With Insurance

-

Get A Last Will and Testament

-

Consider A Living Trust

-

Consider A Financial Power of Attorney

-

Consider A Health Care Power of Attorney

-

Get A Living Will

-

Leave Information for Executor and Statement of Desires

The answers to these questions about Newport Beach Estate Planning in Newport Beach help to determine the path forward. With the talented and committed financial professionals at Miramontes Capital, we make the investment planning process as easy and as clear as possible.

Call today and speak directly with one of our Feduciary Experts, Call Now 800.460.1595

Miramontes Capital is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Miramontes Capital and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Miramontes Capital unless a client service agreement is in place.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, Headquartered at 18 Corporate Woods Blvd., Albany, NY 12211

Purshe Kaplan Sterling Investments and Miramontes Capital are not affiliated companies NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE, INCLUDING LOSS OF PRINCIPAL. NOT INSURED BY ANY STATE OR FEDERAL AGENCY. @ Miramontes Capital | LEGAL INFORMATION