Investment Planning Newport Beach

Miramontes Capital, Investment Planning Newport Beach, specializes in helping clients achieve their investment planning goals. Our team of Certified Investment Planning fiduciaries works directly with each client, developing plans that work for current needs as well as future investing objectives.

Miramontes Investment Planning Newport Beach, Creating Legacies One Portfolio At A Time

Investment Planning Newport Beach With Miramontes Capital

The talented Newport Beach investment planning professionals at Miramontes Capital work directly with each client, developing the right financial plan. Our team excels at breaking down the financial planning concepts into easy-to-understand terminologies, as a result, you will fully understand your investment plan.

Call today and speak directly with one of our Newport Beach Investment Planning Experts, Call Now 800.460.1595

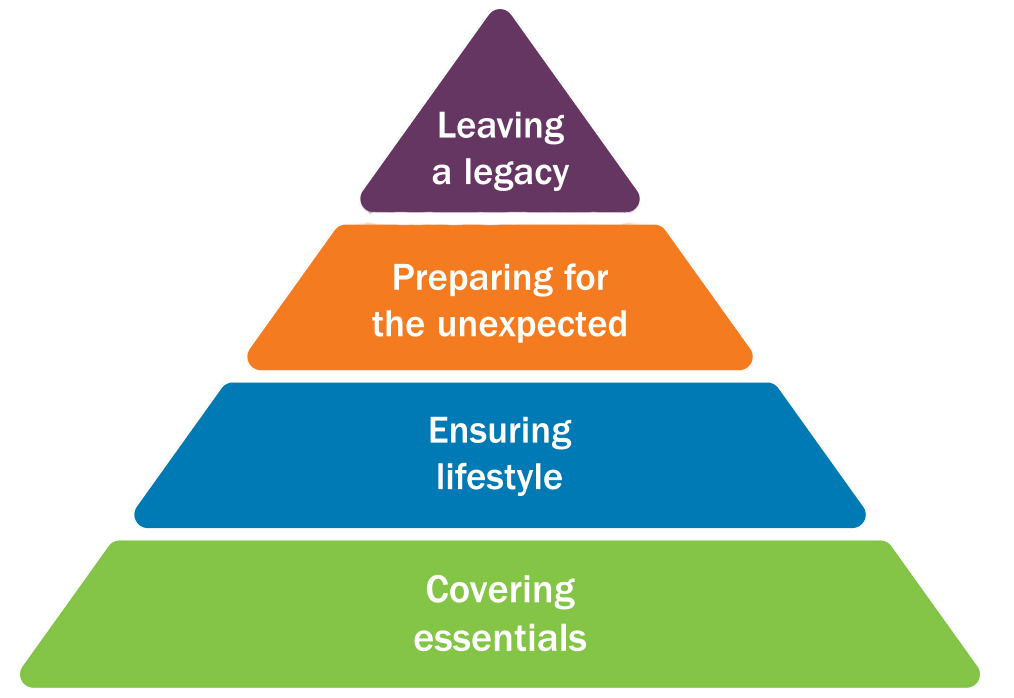

Ask Yourself….What Are My Investment Planning Priorities?

Each person has different goals and needs in mind when they think of retirement; some may dream of a vacation home in the mountains, while others want to travel the world. Still, others may simply want to ensure that their loved ones will have the funds needed to pay for expenses well into the future.

Regardless of a person’s financial needs and goals, our experienced team of investment planning Newport beach fiduciaries map out a plan that is easy to follow, easy to manage, and tailored specifically to the needs of each of our clients.

What is Investment Planning?

In simple terms, investment planning is a process by which one identifies their financial goals now and into the future. Then we create an investment strategy to help you meet those goals. Investment goals can take many forms, including buying a home, funding college tuition for children, setting aside money for retirement, or taking a well-deserved trip around the world.

- Constructing a Total Return Investment Portfolio

- Use Retirement Income Funds

- Immediate Annuities

- Buy Bonds

- Rental Real Estate

- Variable Annuity With a Lifetime Income Rider

- Keep Some Safe Investments

- Income Producing Closed-End Funds

- Dividends and Dividend Income Funds

- Real Estate Investment Trusts

Newport Beach Investment Planning Simplified with Miramontes Capital.

We understand that investment planning can be a complex process, and that our clients will have many questions. Our planners walk each client through the process, helping to identify goals, objectives, and needs and developing an investment plan that meets those goals.

Investment plans typically include allocation of funds toward the purchase of stocks, bonds, real estate, or retirement savings. With a solid investment plan in place, you are able to match your financial resources with your goals and objectives, both in your current life and well after retirement.

Stay up to date with financial news, click here.

Request Your Free, Newport Beach Investment Planning Consultation

Retirement Planning Guide Book

Get Your Free Copy Of Our Top Selling Book “Retirement, Your New Beginning” And Get The Answers You’ve Always Wondered ABout To Ensure A Secure FInancial FUture For Your Retirement Years.

Miramontes Capital is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Miramontes Capital and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Miramontes Capital unless a client service agreement is in place.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, Headquartered at 18 Corporate Woods Blvd., Albany, NY 12211

Purshe Kaplan Sterling Investments and Miramontes Capital are not affiliated companies NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE, INCLUDING LOSS OF PRINCIPAL. NOT INSURED BY ANY STATE OR FEDERAL AGENCY. @ Miramontes Capital | LEGAL INFORMATION